A trend is emerging in California’s dynamic real estate market as office owners consider the possibility of converting buildings for other purposes. An increasing number of investors and developers have shown interest in conversion projects, according to a recent poll by well-known law firm Allen Matkins and the University of California, Los Angeles.

The poll results, which were released on Wednesday, provide insight into the opinions of almost 200 industry participants dispersed over important Californian areas, including the Bay Area, Sacramento, Los Angeles, and San Diego. Of those surveyed, a startling twenty-one percent said they intended to convert their current office facilities for “alternative purposes” during the following three years. These “alternative purposes” may include everything from housing projects to retail endeavors and more.

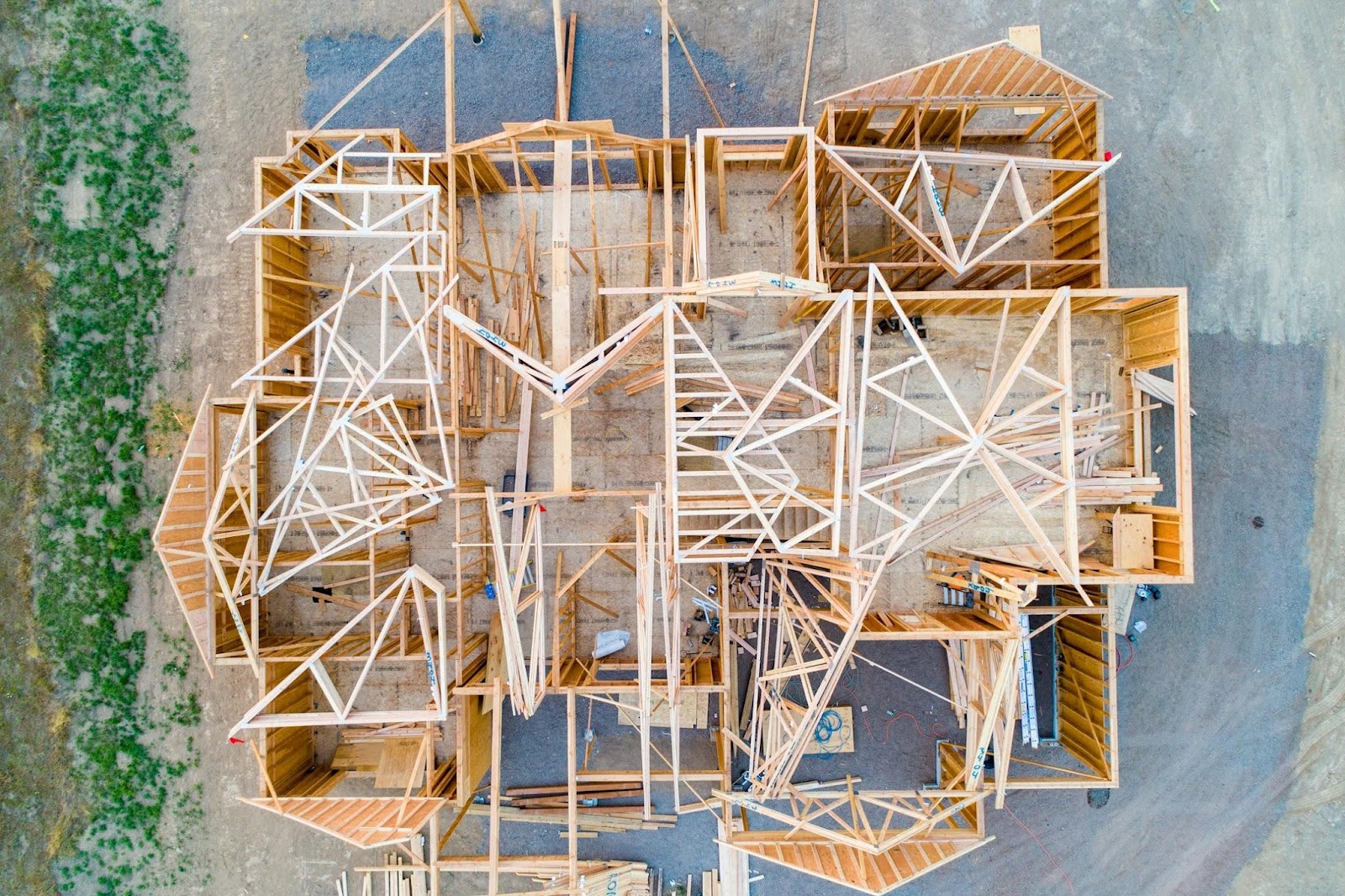

Though there is a clear passion for repurposing office properties, John Tipton, a partner at Allen Matkins focused on commercial real estate transactions, pointed out that there are several obstacles along the way from idea to actuality. Tipton emphasizes the difficult and expensive nature of workplace conversions, warning that while there has been a lot of interest, there hasn’t been much real execution.

Industry insiders list the significant financial outlay necessary to carry out effective conversion projects. As the study indicates a general feeling of gloom, especially in the Los Angeles office market, investors and developers are battling residual doubts from the turbulent Covid-19 epidemic aftermath.

The idea of converting offices to homes has gained popularity, driven by the urgent demand for housing alternatives in heavily populated urban areas like Los Angeles. Proponents contend that converting old, abandoned office buildings into homes is in line with larger urban rehabilitation initiatives and solves the housing issue.

But the sustainability of such ventures depends on several factors, including market demand, legal frameworks, and financial viability. Even though adaptive reuse has its appeal, many developers are intimidated by the high investment in an unstable economy and the challenge of overcoming regulatory obstacles.

Moreover, the decision of whether to continue conversion projects or simply demolish existing structures is complicated. Older office buildings pose a serious problem for landlords as they may require more renovation than newer constructions. Tipton points out that many landlords are debating the benefits of conversion, and whether the choice will be a cost-effective solution or more expensive in the long run.

California’s real estate market continues to be affected by these conversations surrounding adaptive reuse and urban redevelopment. While the thought of converting old office buildings for other purposes is certainly appealing to investors and property owners alike, the practicality is challenging. This emphasizes the need for creative problem-solving and considerate planning as the real estate environment continues to shift.

However, as conversion comes into mainstream conversations, it shows that sophisticated strategies are being used to change significant problems. While there may be challenges ahead for this initiative, including budgetary limitations and regulations, it still represents a crucial step for California’s real estate market. Adapting office buildings for new uses is a testament to California’s creativity and flexibility as they face these unprecedented changes.