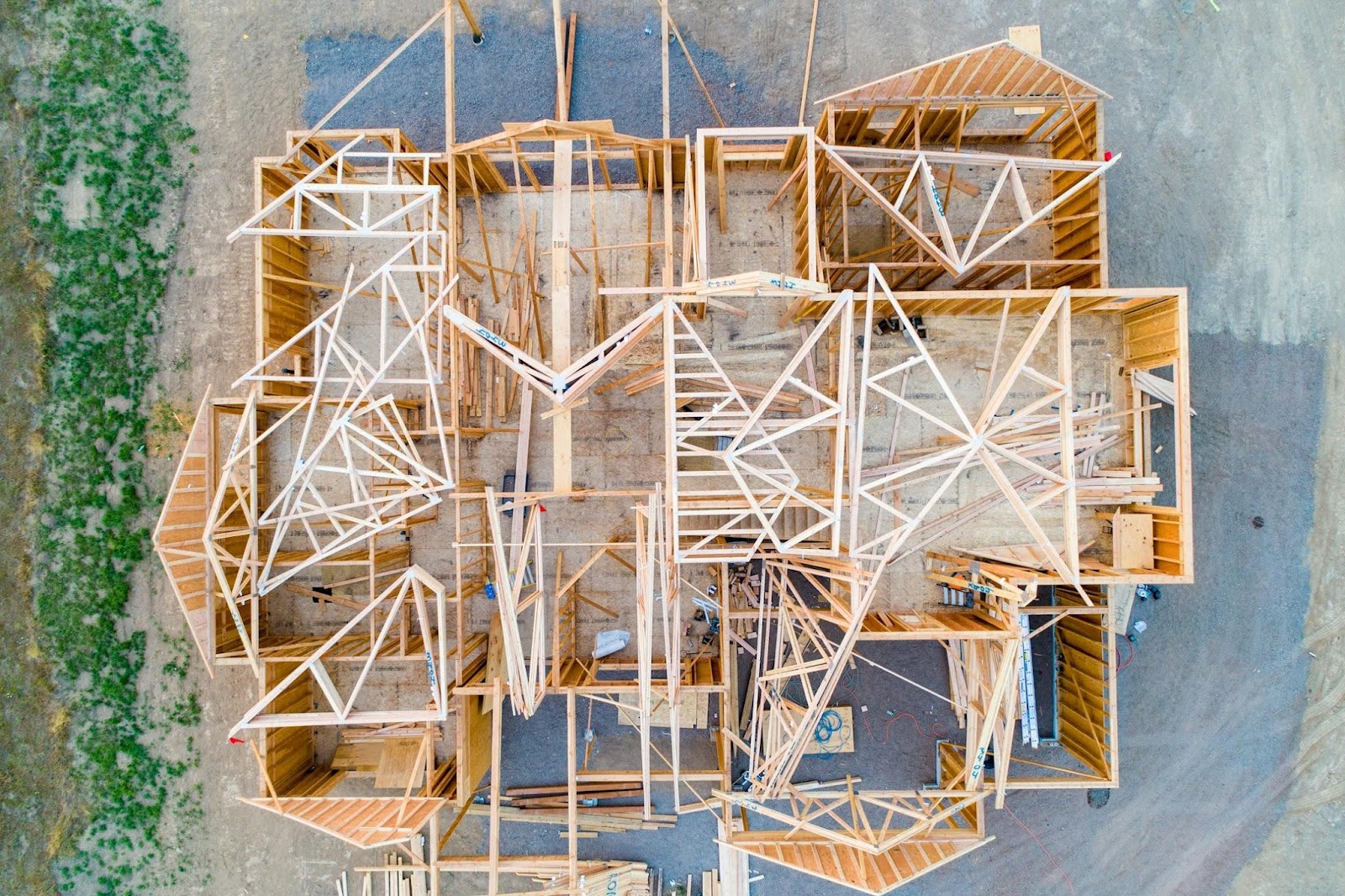

The AON Center, Los Angeles’ third-tallest tower, recently changed hands in a deal that has caught the industry’s attention. The skyscraper, located at 707 Wilshire Blvd., was acquired by private investors led by Los Angeles-based Carolwood LP for approximately $147.8 million, marking a 45% reduction from its 2014 purchase price. The transaction highlights room for opportunity amid urban office properties’ current challenges.

The sale of AON Center, representing the largest office deal in downtown Los Angeles this year, mirrors the struggles of the US office market, grappling with high vacancies and financing costs intensified by the remote work trend and rising interest rates. Sean Fulp, a Colliers broker involved in the deal, emphasized the advantageous position of the new owners. He stated that, with a new low basis and a well-capitalized owner, AON Center would be competitively positioned to attract and retain tenants seeking a skyline tower with desirable amenities in the heart of downtown Los Angeles.

Sean Fulp and Adam Tischer of Colliers represented the buyers, while Kevin Shannon, Ken White, Rob Hannan, Laura Stumm, Michael Moll, Chris Benton, and Anthony Muhlstein of Newmark represented the seller. Dave Milestone of Newmark arranged debt financing for the transaction. With its remarkable views, floor-to-ceiling windows, and LEED Platinum Certification, AON Center is an iconic structure in the ever-evolving Downtown Los Angeles area.

The buyers, comprising Carolwood, Daniel Abrams, and Adam Tischer, navigated a market where almost 30% of downtown LA office space was available for lease or sublease in the third quarter. The neighborhood’s challenging commutes and a high homeless population have contributed to the lower appeal, with downtown rents 40% lower than in more desirable areas. The acquisition stands out as a strategic move amidst the struggles, demonstrating the flow of private capital into Los Angeles during market dislocation.

While the sale price of approximately $134 per square foot reflects a significant decline from the tower’s 2014 purchase price of $268.5 million, the AON Center remains a pivotal structure in downtown Los Angeles. Colliers emphasized that this transaction, encompassing over 1.1 million square feet of space, is the only sale in the region for tower properties exceeding one million square feet since 2020. The deal also signifies a potential recovery for downtown LA’s office investment demand. Sean Fulp hinted at a budding recovery, suggesting that discerning investors seizing generational opportunities are vital to reviving areas like downtown.

Despite the challenges faced by downtown Los Angeles, where office vacancy rates stood at 19.2% as of December 2023, opportunistic investors see potential in acquiring assets at relative bargain prices. The AON Center deal, currently about 67% leased, is the second-largest office sale of 2023 in the LA region, reinforcing the notion that strategic acquisitions can be vital in revitalizing the market.

The sale of AON Center highlights the struggles of downtown LA’s office market and points toward a potential recovery as investors seize opportunities. The new owners, strategically positioned with a reset basis, are expected to compete effectively for tenants, contributing to the rejuvenation of the Downtown Los Angeles market.