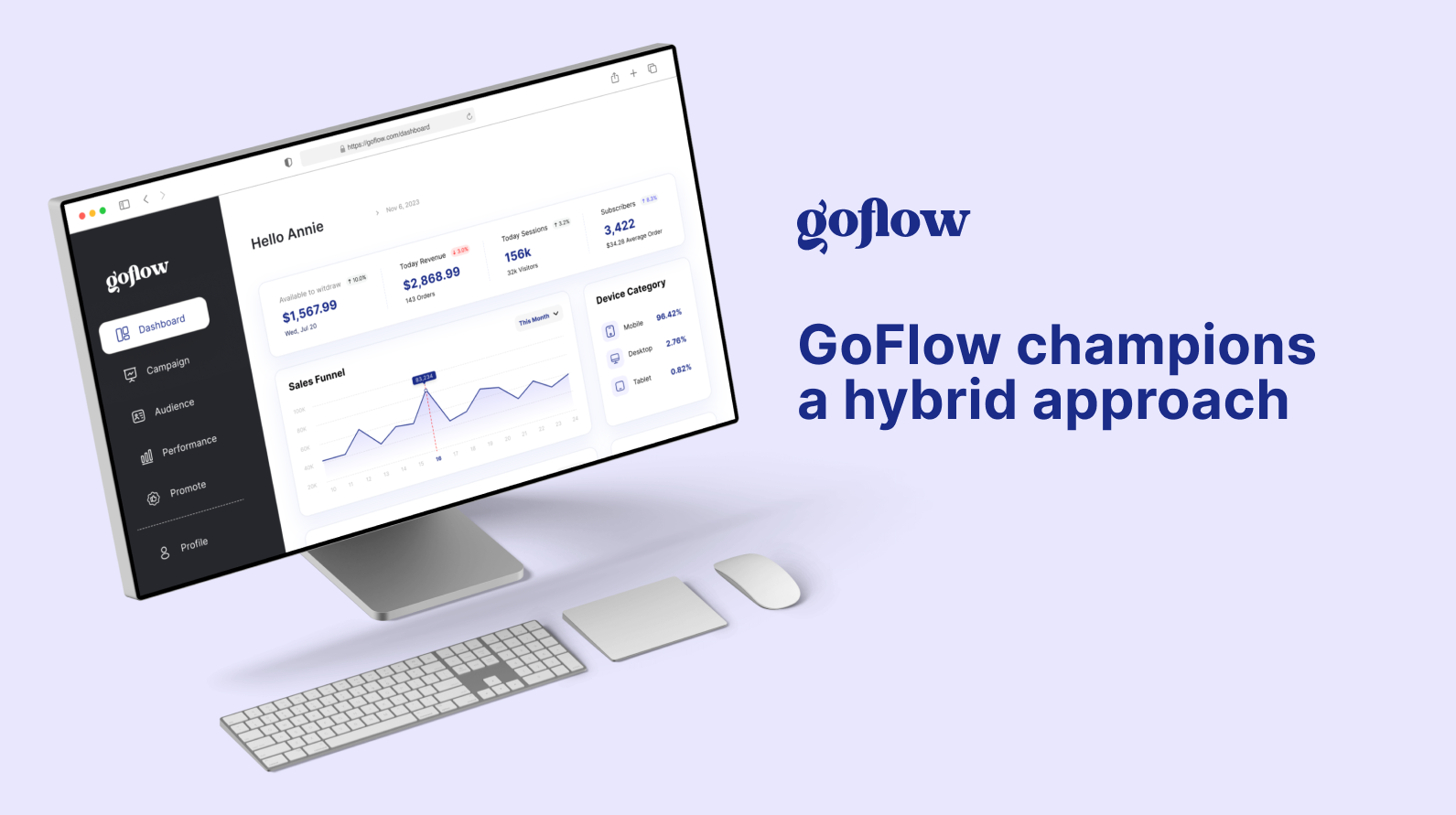

When it comes to the rapidly evolving tech world, investment landscapes aren’t being left behind. And companies like GoFlow are at the forefront of this paradigm shift. Bringing a fresh approach to the traditional world of investments, GoFlow is capitalizing on the capabilities of advanced artificial intelligence to optimize investment processes and provide sharper, more informed strategies for its users.

Deep learning technology, a subset of AI, is known for its profound data-analyzing abilities. GoFlow has deftly incorporated this into its platform, allowing it to conduct extensive investment research, scoring stocks based on user risk preferences. It’s a transformative move — offering individual investors a set of AI-driven tools that can evaluate the history of multiple securities, categorize investment options, and even execute trades if the user wishes.

But where GoFlow truly shines is in the realm of risk assessment. The global economy’s intricacies are a daunting challenge for any investor. With GoFlow’s AI capabilities, it can swiftly analyze vast amounts of data, discern patterns, and predict future market movements with striking accuracy. This predictive element is what many investors crave, and GoFlow is more than equipped to deliver.

Sentiment analysis is another area where GoFlow’s tech prowess becomes evident. While emotional decisions can often skew an investor’s strategy, GoFlow’s AI remains objective. By employing Natural Language Processing (NLP), it examines a myriad of content sources, identifying sentiment shifts that could influence stock performance. It’s a revolutionary move, providing real-time insights based on current news stories, social media buzz, and more.

However, the pièce de résistance of GoFlow’s technology suite has to be its exploration into Artificial General Intelligence (AGI). While most AI systems are designed for specific tasks, AGI is the ambitious attempt to mirror human intelligence’s vastness and versatility. For investors, this means a platform that can potentially simulate myriad investment scenarios, from global pandemics to significant tech advancements, offering unprecedented foresight.

Although fully realized AGI remains a topic of intense research, GoFlow’s ambitious stride in that direction signals a promising trajectory for AI in the investment domain.

Written in partnership with Tom White.