Image credit: Unsplash

Supervisors for Los Angeles County unanimously voted Tuesday June 25 to purchase and forgive millions in medical debt in order to take on the $2.9 billion weight which hangs over nearly 800,000.

This part of a larger and more comprehensive plan, prepared by supervisors Holly Mitchell and Janice Hahn, permits LA County to enter a pilot program with the national organization previously named RIP Medical Debt, now known as Undue Medical Debt.

Undue Medical Debt seeks to relieve patients’ medical debts by retiring those debts after purchasing them for pennies on the dollar.

“Medical debt is largely out of people’s control, but it is devastating families across L.A. County, especially for people living on the brink of poverty,” Hahn stated prior to the vote. “Luckily for us, this is low-hanging fruit. I think we have a moral obligation to seize this opportunity.”

This debt purchase measure is one section of a larger county drive toward efforts to prevent medical debt from occurring in the first place, with initiatives including tracking hospital debt collection practices and boosting programs for hospital financial assistance.

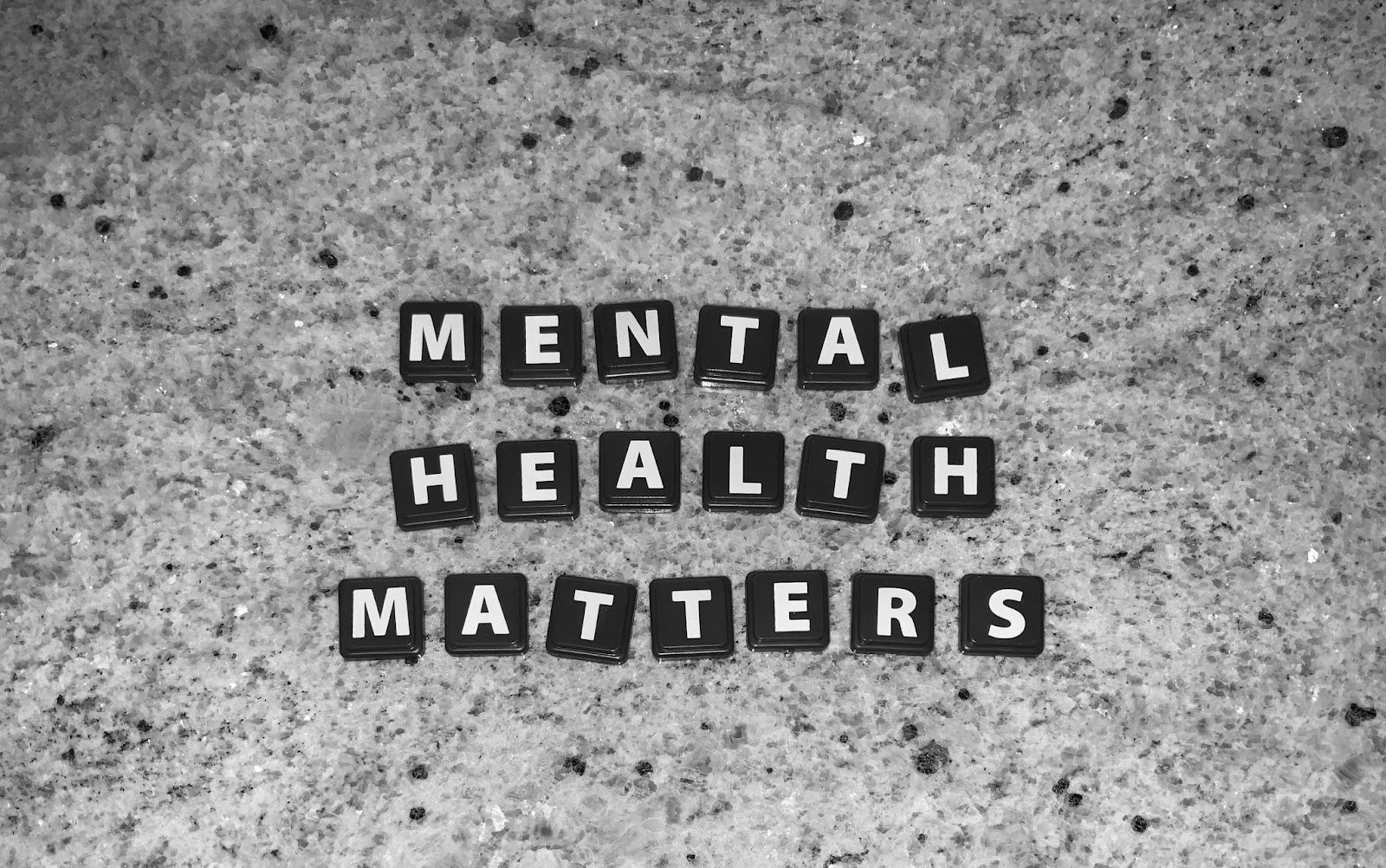

Objections were raised, however, as the Hospital Association of Southern California called out the county’s overarching plans through a letter to the Board of Supervisors, writing that the plan unfairly targeted hospitals while citing research that showed how one-time debt relief programs did not improve patient mental well-being.

Supervisor Hahn’s office believes the $5 million public health investment into the county will help negate $500 million in debt and reach 150,000 residents. Individuals in the public health department have commented they aim on launching the pilot in the next few months to provide Angelenos relief in 2024. Mitchell’s staff have said that if the pilot is successful, additional funds could be allocated in the future.

Although the county is pleased with the immediate relief their program offers, they have stated they seek a more long-term solution which would help residents avoid accruing additional debt in the future. Some, such as national health policy and equity organization Community Catalyst’s Mona Shah, support the county’s efforts of combining one-time debt forgiveness with programs that more directly take on the sources of medical debt.

“We don’t want to ever deny that relief, but we really need to focus on preventing medical debt from happening in the first place,” Shah commented. “Otherwise, it just ends up being this vicious cycle where you’re relieved, and then the next day you can be back in the same situation again.”

Shah has also expressed concerns for programs that continue to allow hospitals to fail to uphold legally required assistance programs for patients with low incomes. Nonprofit hospitals are mandated to instate charity care, as is required of all hospitals in California.

Undue Medical Debt generally partners with groups of physicians or hospitals to help identify individuals whose debt is greater than 5% of their annual income or who are making below 400% of the federal poverty line. After identification, these organizations negotiate for a purchasing price and then purchase the debt to retire it.

Allison Sesso noted Undue Medical Debt’s utilization of patient eligibility reviews as a method to communicate with hospitals and come to a consensus on improvement opportunities for financial policies.

Health and wellness senior deputy of Mitchell’s office, Yolanda Vera, explained how the county recognizes the need for more permanent relief than what a one-time program can offer, stating “We have to try every tool we can to improve the economic well-being in our community, and this is one of them.”